After a long stretch of elevated rates and heavy inventory, the Texas housing market is finally showing signs of renewed momentum. Thanks to two recent rate drops, buyer confidence has improved, and sales activity is picking up across several key markets. While inventory remains above pre-pandemic levels, the combination of lower borrowing costs and stronger demand is helping to rebalance conditions statewide.

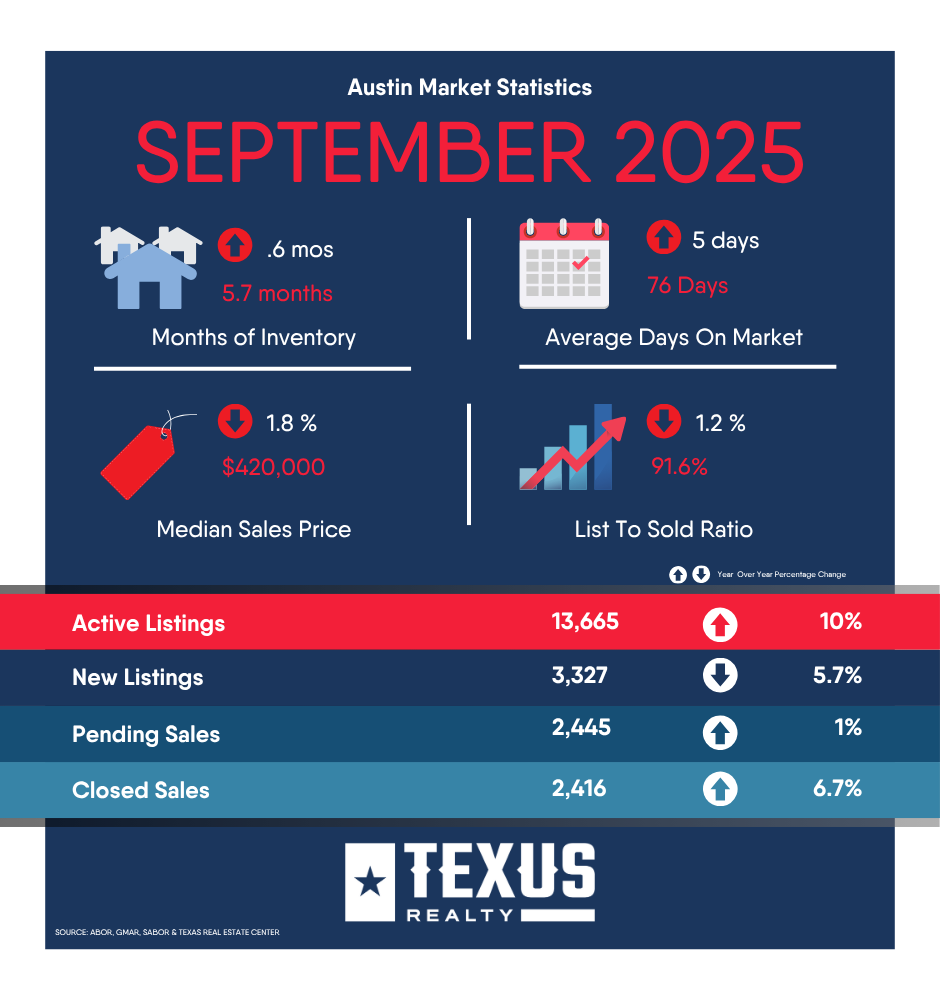

In Austin, closed sales are up 6.7% year-over-year, marking one of the metro’s strongest gains of 2025. The median home price has stabilized near $420,000, and listings are beginning to move more quickly as buyer activity returns. Though inventory is still high, the recent rate cuts have encouraged many sidelined buyers to re-enter the market, signaling a potential shift heading into the fall.

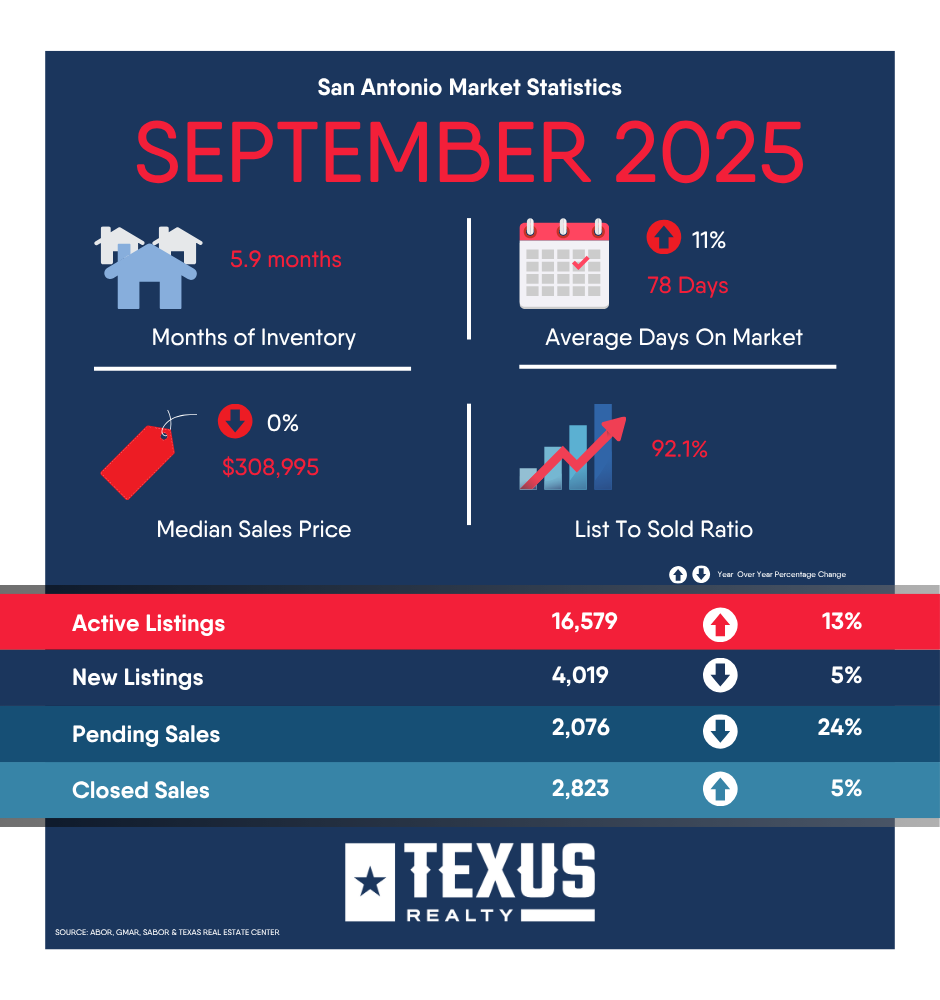

San Antonio remains steady, with sales up 5% compared to last year and prices holding firm around the $308,000 mark. The city’s balanced conditions and steady job growth continue to support healthy demand, even as inventory sits near six months of supply.

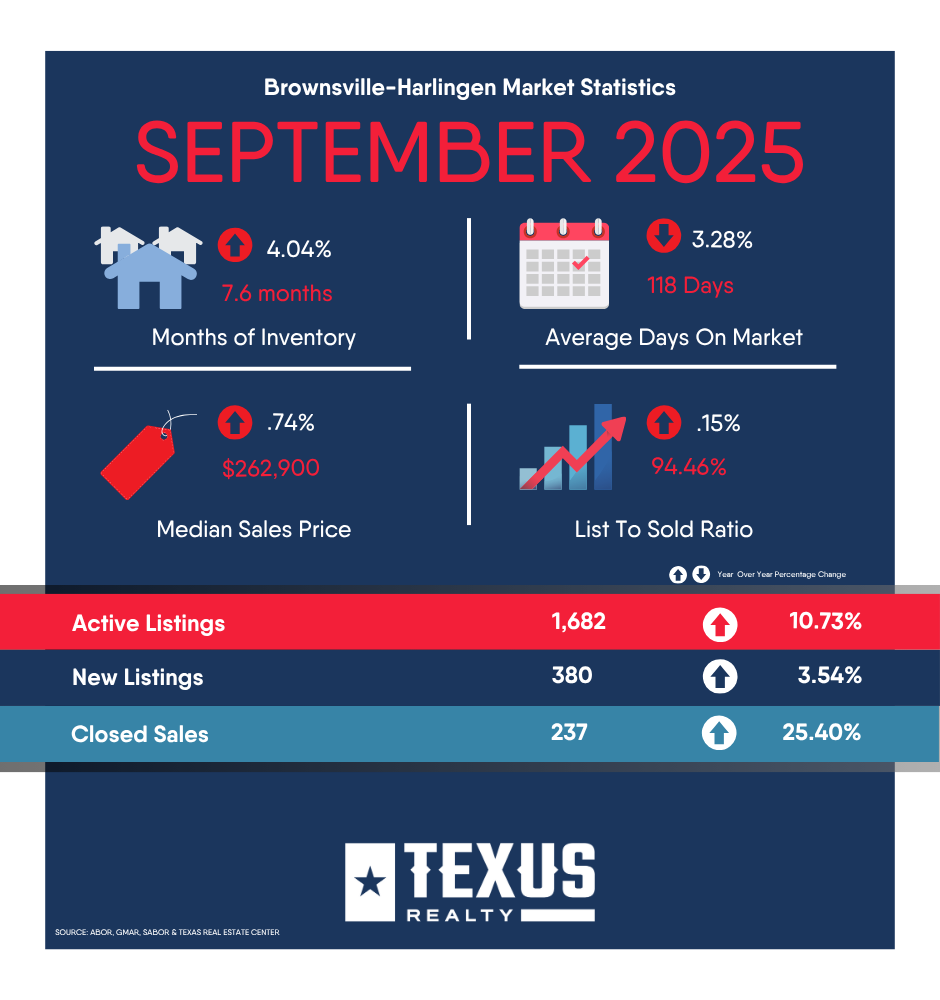

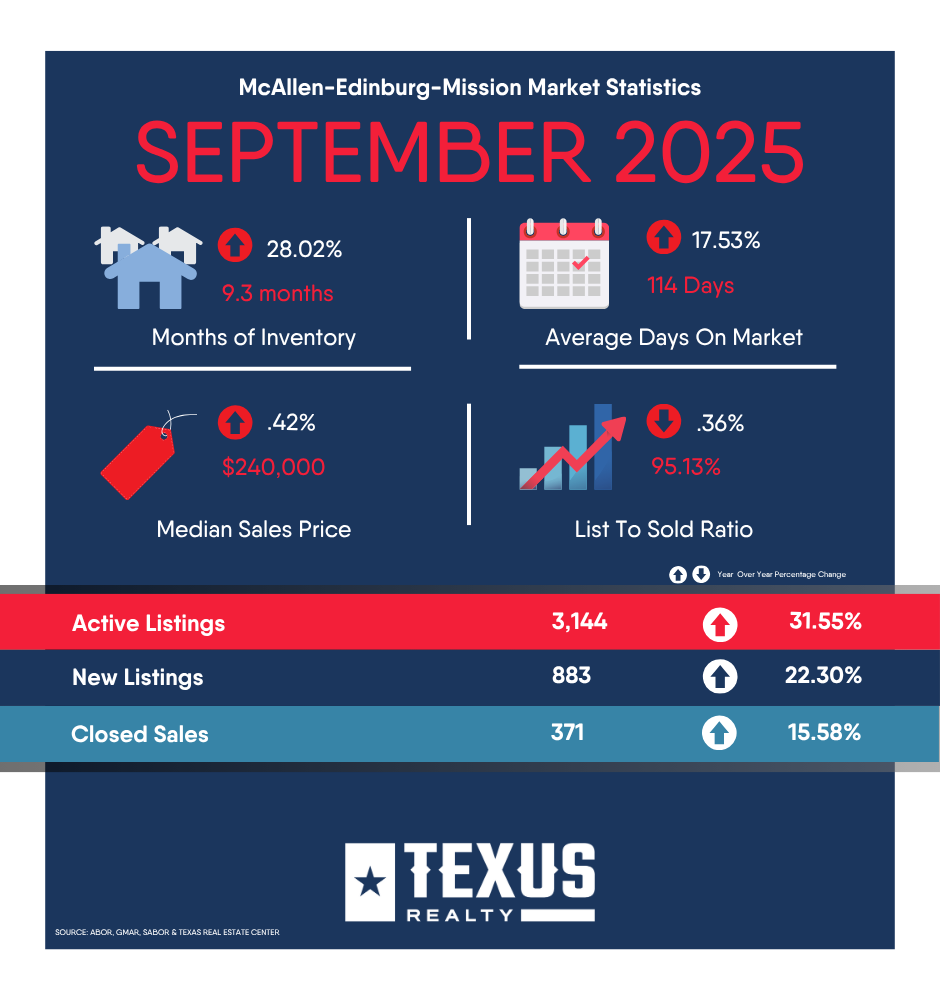

In the Rio Grande Valley, momentum has been even stronger. The Brownsville–Harlingen area posted a 25% jump in closed sales, making it one of the hottest submarkets in Texas. Median prices remain affordable near $262,000, and homes are selling faster than earlier in the year. Meanwhile, McAllen continues to carry higher inventory levels, but sales are up 15%, helping to offset the added supply and keep prices stable in the mid-$240,000s.

On the rental side, conditions remain steady. In Austin, average lease rates are down only slightly—less than 1% year-over-year—but occupancy and demand remain strong, with most properties achieving close to full asking rent. Statewide, steady rental performance continues to provide stability for investors and property owners alike.

Overall, the September market reflects a cautious optimism across Texas. With mortgage rates finally easing and sales trending upward, the market appears to be shifting out of its holding pattern. If borrowing costs continue to improve through the end of the year, 2026 could bring a much-needed resurgence in both buyer activity and price growth across the state.